此题为判断题(对,错)。

According to this passage, a money market

A.provides convenient services to its customers.

B.has close contact with the individuals or firms seeking funds.

C.maintains accounts with various retailers of financial services.

D.is made up of institutions who specialize in handling wholesale monetary transactions.

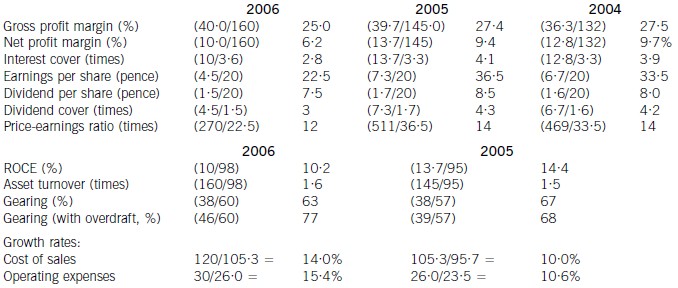

(ii) the recent financial performance of Merton plc from a shareholder perspective. Clearly identify any

issues that you consider should be brought to the attention of the ordinary shareholders. (15 marks)

(ii) Discussion of financial performance

It is clear that 2006 has been a difficult year for Merton plc. There are very few areas of interest to shareholders where

anything positive can be found to say.

Profitability

Return on capital employed has declined from 14·4% in 2005, which compared favourably with the sector average of

12%, to 10·2% in 2006. Since asset turnover has improved from 1·5 to 1·6 in the same period, the cause of the decline

is falling profitability. Gross profit margin has fallen each year from 27·5% in 2004 to 25% in 2006, equal to the sector

average, despite an overall increase in turnover during the period of 10% per year. Merton plc has been unable to keep

cost of sales increases (14% in 2006 and 10% in 2005) below the increases in turnover. Net profit margin has declined

over the same period from 9·7% to 6·2%, compared to the sector average of 8%, because of substantial increases in

operating expenses (15·4% in 2006 and 10·6% in 2005). There is a pressing need here for Merton plc to bring cost

of sales and operating costs under control in order to improve profitability.

Gearing and financial risk

Gearing as measured by debt/equity has fallen from 67% (2005) to 63% (2006) because of an increase in

shareholders’ funds through retained profits. Over the same period the overdraft has increased from £1m to £8m and

cash balances have fallen from £16m to £1m. This is a net movement of £22m. If the overdraft is included, gearing

has increased to 77% rather than falling to 63%.

None of these gearing levels compare favourably with the average gearing for the sector of 50%. If we consider the large

increase in the overdraft, financial risk has clearly increased during the period. This is also evidenced by the decline in

interest cover from 4·1 (2005) to 2·8 (2006) as operating profit has fallen and interest paid has increased. In each year

interest cover has been below the sector average of eight and the current level of 2·8 is dangerously low.

Share price

As the return required by equity investors increases with increasing financial risk, continued increases in the overdraft

will exert downward pressure on the company’s share price and further reductions may be expected.

Investor ratios

Earnings per share, dividend per share and dividend cover have all declined from 2005 to 2006. The cut in the dividend

per share from 8·5 pence per share to 7·5 pence per share is especially worrying. Although in its announcement the

company claimed that dividend growth and share price growth was expected, it could have chosen to maintain the

dividend, if it felt that the current poor performance was only temporary. By cutting the dividend it could be signalling

that it expects the poor performance to continue. Shareholders have no guarantee as to the level of future dividends.

This view could be shared by the market, which might explain why the price-earnings ratio has fallen from 14 times to

12 times.

Financing strategy

Merton plc has experienced an increase in fixed assets over the last period of £10m and an increase in stocks and

debtors of £21m. These increases have been financed by a decline in cash (£15m), an increase in the overdraft (£7m)

and an increase in trade credit (£6m). The company is following an aggressive strategy of financing long-term

investment from short-term sources. This is very risky, since if the overdraft needed to be repaid, the company would

have great difficulty in raising the funds required.

A further financing issue relates to redemption of the existing debentures. The 10% debentures are due to be redeemed

in two years’ time and Merton plc will need to find £13m in order to do this. It does not appear that this sum can be

raised internally. While it is possible that refinancing with debt paying a lower rate of interest may be possible, the low

level of interest cover may cause concern to potential providers of debt finance, resulting in a higher rate of interest. The

Finance Director of Merton plc needs to consider the redemption problem now, as thought is currently being given to

raising a substantial amount of new equity finance. This financing choice may not be available again in the near future,

forcing the company to look to debt finance as a way of effecting redemption.

Overtrading

The evidence produced by the financial analysis above is that Merton plc is showing some symptoms of overtrading

(undercapitalisation). The board are suggesting a rights issue as a way of financing an expansion of business, but it is

possible that a rights issue will be needed to deal with the overtrading problem. This is a further financing issue requiring

consideration in addition to the redemption of debentures mentioned earlier.

Conclusion

Ordinary shareholders need to be aware of the following issues.

1. Profitability has fallen over the last year due to poor cost control

2. A substantial increase in the overdraft over the last year has caused gearing to increase

3. It is possible that the share price will continue to fall

4. The dividend cut may warn of continuing poor performance in the future

5. A total of £13m of debentures need redeeming in two year’s time

6. A large amount of new finance is needed for working capital and debenture redemption

Appendix: Analysis of key ratios and financial information

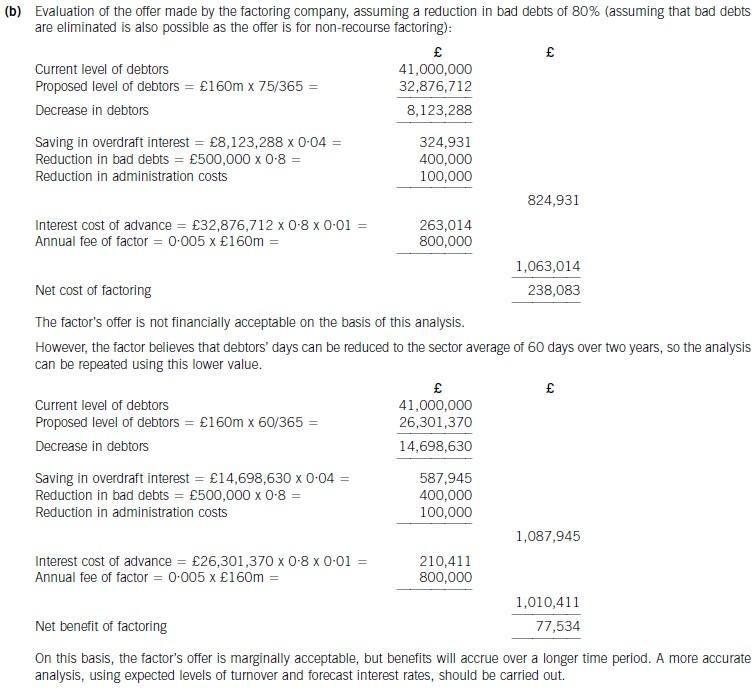

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

2 (a) Discuss the nature of the financial objectives that may be set in a not-for-profit organisation such as a charity

or a hospital. (8 marks)

2 (a) In the case of a not-for-profit (NFP) organisation, the limit on the services that can be provided is the amount of funds that

are available in a given period. A key financial objective for an NFP organisation such as a charity is therefore to raise as

much funds as possible. The fund-raising efforts of a charity may be directed towards the public or to grant-making bodies.

In addition, a charity may have income from investments made from surplus funds from previous periods. In any period,

however, a charity is likely to know from previous experience the amount and timing of the funds available for use. The same

is true for an NFP organisation funded by the government, such as a hospital, since such an organisation will operate under

budget constraints or cash limits. Whether funded by the government or not, NFP organisations will therefore have the

financial objective of keeping spending within budget, and budgets will play an important role in controlling spending and in

specifying the level of services or programmes it is planned to provide.

Since the amount of funding available is limited, NFP organisations will seek to generate the maximum benefit from available

funds. They will obtain resources for use by the organisation as economically as possible: they will employ these resources

efficiently, minimising waste and cutting back on any activities that do not assist in achieving the organisation’s non-financial

objectives; and they will ensure that their operations are directed as effectively as possible towards meeting their objectives.

The goals of economy, efficiency and effectiveness are collectively referred to as value for money (VFM). Economy is

concerned with minimising the input costs for a given level of output. Efficiency is concerned with maximising the outputs

obtained from a given level of input resources, i.e. with the process of transforming economic resources into desires services.

Effectiveness is concerned with the extent to which non-financial organisational goals are achieved.

Measuring the achievement of the financial objective of VFM is difficult because the non-financial goals of NFP organisations

are not quantifiable and so not directly measurable. However, current performance can be compared to historic performance

to ascertain the extent to which positive change has occurred. The availability of the healthcare provided by a hospital, for

example, can be measured by the time that patients have to wait for treatment or for an operation, and waiting times can be

compared year on year to determine the extent to which improvements have been achieved or publicised targets have been

met.

Lacking a profit motive, NFP organisations will have financial objectives that relate to the effective use of resources, such as

achieving a target return on capital employed. In an organisation funded by the government from finance raised through

taxation or public sector borrowing, this financial objective will be centrally imposed.

第一章第二章是选择题会出到重点就是讲IASB简介,和概念框架。第1页,共20页。The objective of financial reporting places most emphasis on:reporting to capital providers.reporting on stewardship.providing specific guidance related to specific needs.providing information to individuals who are experts in the field.Review Question 第一个要知道我们提供信息的重点是什么。Objective of Financial AccountingLO 4 Identify the objectives of financial reporting.第2页,共20页。Two Major Organizations: 这是国际准则,也就是我们这个课本所准从的准则。International Accounting Standards Board (IASB)Issues International Financial Reporting Standards (IFRS).Standards used on most foreign exchanges. Standards used by foreign companies listing on U.S. securities exchanges. IFRS used in over 115 countries.LO 5 Identify the major policy-setting bodies and their role in the standard-setting process.Standard-Setting Organizations第3页,共20页。Two Major Organizations: 美国的准则Financial Accounting Standards Board (FASB)Issues Statements of Financial Accounting Standards (SFAS).Required for all U.S.-based companies. LO 5 Identify the major policy-setting bodies and their role in the standard-setting process.Standard-Setting Organizations第4页,共20页。What the public thinks accountants should do vs. what accountants think they can do.Financial Reporting ChallengesThe Expectations Gap 这是外行人觉得我们会计该干嘛的与我们实际会怎么做的区别。LO 7 Describe the challenges facing financial reporting.Significant Financial Reporting Issues我们提供会计信息的考虑到的一些要素。Non-financial measurementsForward-looking informationSort assetsTimeliness第5页,共20页。LO 5 Identify the major policy-setting bodies and their role in the standard-setting process.Standard-Setting OrganizationsIllustration 1-4International Standard-Setting Structure这是国际准则制定机构的4个组成部分,大家有个印象就好。第6页,共20页。Due ProcessIllustration 1-4International Standard-Setting Structure IASB的如何制定出或修改其准则的步骤。LO 5 Identify the major policy-setting bodies and their role in the standard-setting process.第7页,共20页。IFRS is comprised of: IFRS的组成部分,这个要好好看看。International Financial Reporting Standards and FASB financial reporting standards.International Financial Reporting Standards, International Accounting Standards, and international accounting interpretations.International Accounting Standards and international accounting interpretations.FASB financial reporting standards and International Accounting Standards.Review QuestionTypes of PronouncementsLO 6 Explain the meaning of IFRS.第8页,共20页。The expectations gap is: 这是比较重要的一个概念what financial information management provides and what users want.what the public thinks accountants should do and what accountants think they can do.what the governmental agencies want from standard-setting and what the standard-setters provide.what the users of financial s、tatements want from the government and what is provided.Review QuestionFinancial Reporting ChallengesLO 7 Describe the challenges facing financial reporting.第9页,共20页。The fact that there are differences between IFRS and U.S. GAAP should not be surprising because standard-setters have developed standa、rds in response to different user needs. IFRS tends to be simpler and more flexible in its accounting and disclosure requirements.The U.S. SEC recently eliminated the need for foreign companies that trade shares in U.S. markets to reconcile their accounting with U.S. GAAP. IASB和FASB的总体趋势是趋同的。记住这一点就行

(b) Discuss the relative costs to the preparer and benefits to the users of financial statements of increased

disclosure of information in financial statements. (14 marks)

Quality of discussion and reasoning. (2 marks)

12 Which of the following statements are correct?

(1) Contingent assets are included as assets in financial statements if it is probable that they will arise.

(2) Contingent liabilities must be provided for in financial statements if it is probable that they will arise.

(3) Details of all adjusting events after the balance sheet date must be given in notes to the financial statements.

(4) Material non-adjusting events are disclosed by note in the financial statements.

A 1 and 2

B 2 and 4

C 3 and 4

D 1 and 3

(c) Prepare brief notes for the proposed meeting with Charles and Jane. Clearly identify the further information

you would need in order to advise them more fully and suggest appropriate personal financial planning

protection products, in respect of both death and serious illness. (9 marks)

You should assume that the income tax rates and allowances for the tax year 2005/06 and the corporation tax

rates for the financial year 2005 apply throughout this question.

When considering the shortfall

– The family’s expenditure is likely to increase as the children get older, particularly if there is a need for school fees.

– There will be a need for some cash immediately to pay for the cost of the funeral.

– It is assumed that the whole of Jane’s estate has been left to Charles such that there will be no inheritance tax on her

death.

– The shortfall may be reduced by:

(i) State benefits and tax credits.

(ii) Expenditure on non-essential items, e.g. holidays and entertainment included in the annual expenditure of

£45,500.

(iii) The income generated by Charles if he were to return to work.

– The shortfall may be increased by additional child-care costs due to Charles being a single parent, particularly if he

returns to work full-time.

Further information required

– The level of state benefits and tax credits available to Charles.

– The current level of expenditure on non-essential items.

– The costs of child-care if Charles were to return to work.

– Details of any wills made by Charles or Jane.

– Whether Charles’ investment properties could be sold and the proceeds invested in assets with a higher annual return.

– Whether there is any value in Speak Write Ltd independent of Jane, such that the company could be sold after Jane’s

death.

Other related issues

– The couple should consider making provision for their retirement via pension contributions or some other form. of long

term investment plan.

– The couple should recognise that there would be significant financial problems if Jane were to become seriously ill. In

addition to the family’s income falling as set out above, its expenditure would probably increase.

Protection products

– Term life assurance

A qualifying life policy would pay out a tax-free lump sum on Jane’s death.

– Permanent health insurance

Would provide a regular income if Jane were unable to work due to illness.

– Critical illness insurance

Would provide a capital sum in the event of Jane being diagnosed with an insured illness.

(iii) State the value added tax (VAT) and stamp duty (SD) issues arising as a result of inserting Bold plc as

a holding company and identify any planning actions that can be taken to defer or minimise these tax

costs. (4 marks)

You should assume that the corporation tax rates for the financial year 2005 and the income tax rates

and allowances for the tax year 2005/06 apply throughout this question.

(b) Identify and explain the financial statement risks to be taken into account in planning the final audit.

(12 marks)