第1题:

(ii) the recent financial performance of Merton plc from a shareholder perspective. Clearly identify any

issues that you consider should be brought to the attention of the ordinary shareholders. (15 marks)

(ii) Discussion of financial performance

It is clear that 2006 has been a difficult year for Merton plc. There are very few areas of interest to shareholders where

anything positive can be found to say.

Profitability

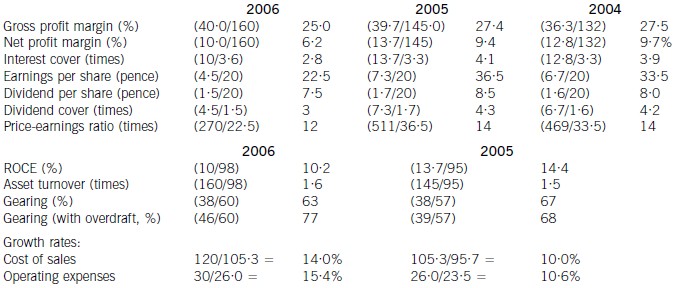

Return on capital employed has declined from 14·4% in 2005, which compared favourably with the sector average of

12%, to 10·2% in 2006. Since asset turnover has improved from 1·5 to 1·6 in the same period, the cause of the decline

is falling profitability. Gross profit margin has fallen each year from 27·5% in 2004 to 25% in 2006, equal to the sector

average, despite an overall increase in turnover during the period of 10% per year. Merton plc has been unable to keep

cost of sales increases (14% in 2006 and 10% in 2005) below the increases in turnover. Net profit margin has declined

over the same period from 9·7% to 6·2%, compared to the sector average of 8%, because of substantial increases in

operating expenses (15·4% in 2006 and 10·6% in 2005). There is a pressing need here for Merton plc to bring cost

of sales and operating costs under control in order to improve profitability.

Gearing and financial risk

Gearing as measured by debt/equity has fallen from 67% (2005) to 63% (2006) because of an increase in

shareholders’ funds through retained profits. Over the same period the overdraft has increased from £1m to £8m and

cash balances have fallen from £16m to £1m. This is a net movement of £22m. If the overdraft is included, gearing

has increased to 77% rather than falling to 63%.

None of these gearing levels compare favourably with the average gearing for the sector of 50%. If we consider the large

increase in the overdraft, financial risk has clearly increased during the period. This is also evidenced by the decline in

interest cover from 4·1 (2005) to 2·8 (2006) as operating profit has fallen and interest paid has increased. In each year

interest cover has been below the sector average of eight and the current level of 2·8 is dangerously low.

Share price

As the return required by equity investors increases with increasing financial risk, continued increases in the overdraft

will exert downward pressure on the company’s share price and further reductions may be expected.

Investor ratios

Earnings per share, dividend per share and dividend cover have all declined from 2005 to 2006. The cut in the dividend

per share from 8·5 pence per share to 7·5 pence per share is especially worrying. Although in its announcement the

company claimed that dividend growth and share price growth was expected, it could have chosen to maintain the

dividend, if it felt that the current poor performance was only temporary. By cutting the dividend it could be signalling

that it expects the poor performance to continue. Shareholders have no guarantee as to the level of future dividends.

This view could be shared by the market, which might explain why the price-earnings ratio has fallen from 14 times to

12 times.

Financing strategy

Merton plc has experienced an increase in fixed assets over the last period of £10m and an increase in stocks and

debtors of £21m. These increases have been financed by a decline in cash (£15m), an increase in the overdraft (£7m)

and an increase in trade credit (£6m). The company is following an aggressive strategy of financing long-term

investment from short-term sources. This is very risky, since if the overdraft needed to be repaid, the company would

have great difficulty in raising the funds required.

A further financing issue relates to redemption of the existing debentures. The 10% debentures are due to be redeemed

in two years’ time and Merton plc will need to find £13m in order to do this. It does not appear that this sum can be

raised internally. While it is possible that refinancing with debt paying a lower rate of interest may be possible, the low

level of interest cover may cause concern to potential providers of debt finance, resulting in a higher rate of interest. The

Finance Director of Merton plc needs to consider the redemption problem now, as thought is currently being given to

raising a substantial amount of new equity finance. This financing choice may not be available again in the near future,

forcing the company to look to debt finance as a way of effecting redemption.

Overtrading

The evidence produced by the financial analysis above is that Merton plc is showing some symptoms of overtrading

(undercapitalisation). The board are suggesting a rights issue as a way of financing an expansion of business, but it is

possible that a rights issue will be needed to deal with the overtrading problem. This is a further financing issue requiring

consideration in addition to the redemption of debentures mentioned earlier.

Conclusion

Ordinary shareholders need to be aware of the following issues.

1. Profitability has fallen over the last year due to poor cost control

2. A substantial increase in the overdraft over the last year has caused gearing to increase

3. It is possible that the share price will continue to fall

4. The dividend cut may warn of continuing poor performance in the future

5. A total of £13m of debentures need redeeming in two year’s time

6. A large amount of new finance is needed for working capital and debenture redemption

Appendix: Analysis of key ratios and financial information

第2题:

(ii) authority; (3 marks)

第3题:

A.must

B.could

C.should

D.might

第4题:

(ii) Recommend which of the refrigeration systems should be purchased. You should state your reasons

which must be supported by relevant calculations. (3 marks)

第5题:

(d) Draft a letter for Tim Blake to send to WM’s investors to include the following:

(i) why you believe robust internal controls to be important; and

(ii) proposals on how internal systems might be improved in the light of the overestimation of mallerite at

WM.

Note: four professional marks are available within the marks allocated to requirement (d) for the structure,

content, style. and layout of the letter.

(16 marks)

You will be aware of the importance of accurate resource valuation to Worldwide Minerals (WM). Unfortunately, I have to

inform. you that the reserve of mallerite, one of our key minerals in a new area of exploration, was found to have been

overestimated after the purchase of a mine. It has been suggested that this information may have an effect on shareholder

value and so I thought it appropriate to write to inform. you of how the board intends to respond to the situation.

In particular, I would like to address two issues. It has been suggested that the overestimation arose because of issues with

the internal control systems at WM. I would firstly like to reassure you of the importance that your board places on sound

internal control systems and then I would like to highlight improvements to internal controls that we shall be implementing

to ensure that the problem should not recur.

(i) Importance of internal control

Internal control systems are essential in all public companies and Worldwide Minerals (WM) is no exception. If anything,

WM’s strategic position makes internal control even more important, operating as it does in many international situations

and dealing with minerals that must be guaranteed in terms of volume, grade and quality. Accordingly, your board

recognises that internal control underpins investor confidence. Investors have traditionally trusted WM’s management

because they have assumed it capable of managing its internal operations. This has, specifically, meant becoming aware

of and controlling known risks. Risks would not be known about and managed without adequate internal control

systems. Internal control, furthermore, helps to manage quality throughout the organisation and it provides

management with information on internal operations and compliance. These features are important in ensuring quality

at all stages in the WM value chain from the extraction of minerals to the delivery of product to our customers. Linked

to this is the importance of internal control in helping to expose and improve underperforming internal operations.

Finally, internal control systems are essential in providing information for internal and external reporting upon which, in

turn, investor confidence rests.

(ii) Proposals to improve internal systems at WM

As you may be aware, mineral estimation and measurement can be problematic, particularly in some regions. Indeed,

there are several factors that can lead to under or overestimation of reserves valuations as a result of geological survey

techniques and regional cultural/social factors. In the case of mallerite, however, the issues that have been brought to

the board’s attention are matters of internal control and it is to these that I would now like to turn.

In first instance, it is clear from the fact that the overestimate was made that we will need to audit geological reports at

an appropriate (and probably lower) level in the organisation in future.

Once a claim has been made about a given mineral resource level, especially one upon which investor returns might

depend, appropriate systems will be instituted to ask for and obtain evidence that such reserves have been correctly and

accurately quantified.

We will recognise that single and verbal source reports of reserve quantities may not necessarily be accurate. This was

one of the apparent causes of the overestimation of mallerite. A system of auditing actual reserves rather than relying

on verbal evidence will rectify this.

The purchase of any going concern business, such as the mallerite mine, is subject to due diligence. WM will be

examining its procedures in this area to ensure that they are fit for purpose in the way that they may not have been in

respect of the purchase of the mallerite mine. I will be taking all appropriate steps to ensure that all of these internal

control issues can be addressed in future.

Thank you for your continued support of Worldwide Minerals and I hope the foregoing goes some way to reassure you

that the company places the highest value on its investors and their loyalty.

Yours faithfully,

Tim Blake

Chairman

第6题:

(b) Discuss how the operating statement you have produced can assist managers in:

(i) controlling variable costs;

(ii) controlling fixed production overhead costs. (8 marks)

(b) Controlling variable costs

The first step in the process of controlling costs is to measure actual costs. The second step is to calculate variances that show

the difference between actual costs and budgeted or standard costs. These variances then need to be reported to those

managers who have responsibility for them. These managers can then decide whether action needs to be taken to bring actual

costs back into line with budgeted or standard costs. The operating statement therefore has a role to play in reporting

information to management in a way that assists in the decision-making process.

The operating statement quantifies the effect of the volume difference between budgeted and actual sales so that the actual

cost of the actual output can be compared with the standard (or budgeted) cost of the actual output. The statement clearly

differentiates between adverse and favourable variances so that managers can identify areas where there is a significant

difference between actual results and planned performance. This supports management by exception, since managers can

focus their efforts on these significant areas in order to obtain the most impact in terms of getting actual operations back in

line with planned activity.

In control terms, variable costs can be affected in the short term and so an operating statement for the last month showing

variable cost variances will highlight those areas where management action may be effective. In the short term, for example,

managers may be able to improve labour efficiency through training, or through reducing or eliminating staff actions which

do not assist the production process. In this way the adverse direct labour efficiency variance of £252, which is 7·3% of the

standard direct labour cost of the actual output, could be reduced.

Controlling fixed production overhead costs

In the short term, it is unlikely that fixed production overhead costs can be controlled. An operating statement from last month

showing fixed production overhead variances may not therefore assist in controlling fixed costs. Managers will not be able to

take any action to correct the adverse fixed production overhead expenditure variance, for example, which may in fact simply

show the need for improvement in the area of budget planning. Investigation of the component parts of fixed production

overhead will show, however, whether any of these are controllable. In general, this is not the case2.

Absorption costing gives rise to a fixed production overhead volume variance, which shows the effect of actual production

being different from planned production. Since fixed production overheads are a sunk cost, the volume variance shows little

more than that the standard hours for actual production were different from budgeted standard hours3. Similarly, the fixed

production overhead efficiency variance offers little more in information terms than the direct labour efficiency variance. While

fixed production overhead variances assist in reconciling budgeted profit with actual profit, therefore, their reporting in an

operating statement is unlikely to assist in controlling fixed costs.

第7题:

(ii) Analyse why moving to a ‘no frills’ low-cost strategy would be inappropriate for ONA.

Note: requirement (b) (ii) includes 3 professional marks (16 marks)

第8题:

(ii) ‘job description’. (4 marks)

第9题:

(ii) Determine whether your decision in (b)(i) would change if you were to use the Maximin and Minimax

regret decision criteria. Your answer should be supported by relevant workings. (6 marks)

第10题:

(ii) The percentage change in revenue, total costs and net assets during the year ended 31 May 2008 that

would have been required in order to have achieved a target ROI of 20% by the Beetown centre. Your

answer should consider each of these three variables in isolation. State any assumptions that you make.

(6 marks)