which; has leaded

which; has been leading

that; has leaded

that; has been leading

第1题:

(ii) the recent financial performance of Merton plc from a shareholder perspective. Clearly identify any

issues that you consider should be brought to the attention of the ordinary shareholders. (15 marks)

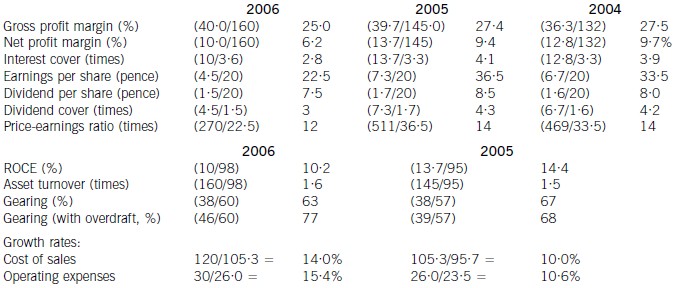

(ii) Discussion of financial performance

It is clear that 2006 has been a difficult year for Merton plc. There are very few areas of interest to shareholders where

anything positive can be found to say.

Profitability

Return on capital employed has declined from 14·4% in 2005, which compared favourably with the sector average of

12%, to 10·2% in 2006. Since asset turnover has improved from 1·5 to 1·6 in the same period, the cause of the decline

is falling profitability. Gross profit margin has fallen each year from 27·5% in 2004 to 25% in 2006, equal to the sector

average, despite an overall increase in turnover during the period of 10% per year. Merton plc has been unable to keep

cost of sales increases (14% in 2006 and 10% in 2005) below the increases in turnover. Net profit margin has declined

over the same period from 9·7% to 6·2%, compared to the sector average of 8%, because of substantial increases in

operating expenses (15·4% in 2006 and 10·6% in 2005). There is a pressing need here for Merton plc to bring cost

of sales and operating costs under control in order to improve profitability.

Gearing and financial risk

Gearing as measured by debt/equity has fallen from 67% (2005) to 63% (2006) because of an increase in

shareholders’ funds through retained profits. Over the same period the overdraft has increased from £1m to £8m and

cash balances have fallen from £16m to £1m. This is a net movement of £22m. If the overdraft is included, gearing

has increased to 77% rather than falling to 63%.

None of these gearing levels compare favourably with the average gearing for the sector of 50%. If we consider the large

increase in the overdraft, financial risk has clearly increased during the period. This is also evidenced by the decline in

interest cover from 4·1 (2005) to 2·8 (2006) as operating profit has fallen and interest paid has increased. In each year

interest cover has been below the sector average of eight and the current level of 2·8 is dangerously low.

Share price

As the return required by equity investors increases with increasing financial risk, continued increases in the overdraft

will exert downward pressure on the company’s share price and further reductions may be expected.

Investor ratios

Earnings per share, dividend per share and dividend cover have all declined from 2005 to 2006. The cut in the dividend

per share from 8·5 pence per share to 7·5 pence per share is especially worrying. Although in its announcement the

company claimed that dividend growth and share price growth was expected, it could have chosen to maintain the

dividend, if it felt that the current poor performance was only temporary. By cutting the dividend it could be signalling

that it expects the poor performance to continue. Shareholders have no guarantee as to the level of future dividends.

This view could be shared by the market, which might explain why the price-earnings ratio has fallen from 14 times to

12 times.

Financing strategy

Merton plc has experienced an increase in fixed assets over the last period of £10m and an increase in stocks and

debtors of £21m. These increases have been financed by a decline in cash (£15m), an increase in the overdraft (£7m)

and an increase in trade credit (£6m). The company is following an aggressive strategy of financing long-term

investment from short-term sources. This is very risky, since if the overdraft needed to be repaid, the company would

have great difficulty in raising the funds required.

A further financing issue relates to redemption of the existing debentures. The 10% debentures are due to be redeemed

in two years’ time and Merton plc will need to find £13m in order to do this. It does not appear that this sum can be

raised internally. While it is possible that refinancing with debt paying a lower rate of interest may be possible, the low

level of interest cover may cause concern to potential providers of debt finance, resulting in a higher rate of interest. The

Finance Director of Merton plc needs to consider the redemption problem now, as thought is currently being given to

raising a substantial amount of new equity finance. This financing choice may not be available again in the near future,

forcing the company to look to debt finance as a way of effecting redemption.

Overtrading

The evidence produced by the financial analysis above is that Merton plc is showing some symptoms of overtrading

(undercapitalisation). The board are suggesting a rights issue as a way of financing an expansion of business, but it is

possible that a rights issue will be needed to deal with the overtrading problem. This is a further financing issue requiring

consideration in addition to the redemption of debentures mentioned earlier.

Conclusion

Ordinary shareholders need to be aware of the following issues.

1. Profitability has fallen over the last year due to poor cost control

2. A substantial increase in the overdraft over the last year has caused gearing to increase

3. It is possible that the share price will continue to fall

4. The dividend cut may warn of continuing poor performance in the future

5. A total of £13m of debentures need redeeming in two year’s time

6. A large amount of new finance is needed for working capital and debenture redemption

Appendix: Analysis of key ratios and financial information

第2题:

A、do

B、is

C、does

第3题:

It is suggested in paragraph 2 that New Englanders__________.

[A] experienced a comparatively peaceful early history.

[B] brought with them the culture of the Old World

[C] paid little attention to southern intellectual life

[D] were obsessed with religious innovations

第4题:

Europeans brought carnival to the Caribbean ,but Caribbean carnival traditions are more rooted in ancient African culture than inherited from European culture.()

第5题:

ireland is a traditional culture which has derived from its rich folk heritage. ()

第6题:

A.brought in

B.brought down

C.brought out

D.brought up

第7题:

Japan s productivity has overtaken America s in some manufacturing industries, but elsewhere the United States has ( )its lead.

A、take up

B、brought back

C、rested on

D、clung to

第8题:

D

Liverpool, my hometown, is a unique city. It is so unique that in 2004 it became a World Heritage (遗产) Site.

I recently returned to my home city and my first stop was at a museum on the River Mersey. Blanketed in mist (薄雾), Victorian architecture rose from the banks of the river, responded to the sounds of sea-birds, and appeared unbelievably charming. When I headed toward the centre, I found myself surrounded by buildings that mirror the best palaces of Europe. It is not hard to imagine why, on first seeing the city, most visitors would be overpowered by the beauty of the noble buildings, which are solid signs of Liverpool’s history.

As if stress its cultural role, Liverpool has more museums and galleries (美术馆) than most cities in Britain. At Walker Art Gallery, I was told that it has best collections of Victorian paintings in the world, and is the home of modern art in the north of England. However, culture is more than galleries. Liverpool offers many music events. As Britain’s No.1 music city, it has the biggest city music festival in Europe, and its musicians are famous all over the world. Liverpool is also well-known for its football and other sports events. Every year, the Mersey River Festival attracts thousands of visitors, madding the city a place of wonder.

As you would expect from such a city, there are restaurants serving food from around the world. When my trip was about to complete, I chose to rest my legs in Liverpool’s famous Philharmonic pub (酒馆). It is a monument to perfection, and a heritage attraction itself.

Being a World Heritage Site, my home city is certainly a place of “outstanding universal value”. It is a treasure house with plenty of secrets for the world to explore.

68. Visitors who see the city for the first time would be deeply impressed by __________.

A. its charming banks

B. its famous museums

C. its wonderful palaces

D. its attractive buildings

第9题:

Every business has its ups and downs, and so()every person.

A. is

B. does

C. do

第10题:

It is suggested in Paragraph 2 that New Englanders

A.experienced a comparatively peaceful early history.

B.brought with them the culture of the Old World.

C.paid little attention to southern intellectual life.

D.were obsessed with religious innovations.