One of its tasks is to get business information and () new business opportunities for its members.

第1题:

It is certain that men will never stop _____ new energy sources to power their growing industry.

A. finding

B. to find

C. having found

D. found

第2题:

Nowadays a private business usually obtains its working capital through a commercial bank.

A.Right

B.Wrong

C.Doesn't say

第3题:

It can be learned from paragraph 4 that

A. Straitford's prediction about Ukraine has proved true.

B. Straitford guarantees the truthfulness of its information.

C. Straitford's business is characterized by unpredictability.

D. Straitford is able to provide fairly reliable information.

第4题:

A public company that fails to obey the new law could be forced to( )

[A] pay a heavy fine

[B] close down its business

[C] change to a private business

[D] sign a document promising to act

第5题:

Every business has its ups and downs, and so()every person.

A. is

B. does

C. do

第6题:

A、do

B、is

C、does

第7题:

请根据短文内容判断给出的语句是否正确,正确的写“T”,错误的写“F”。

An annual report of a company provides information about its business performance for certain people. These people include the investors, potential investors and other stakeholders. From the report, people can understand the company's business scope, recent situation and future development. The main parts of an annual report usually include chairman's letter, operation analysis and financial statements.

·Chairman's Letter

Usually, an annual report should contain a letter from the chairman. The letter should provide details about the successes and the challenges of the past year. It should also include the future outlook for the company.

·Operation Analysis

The operation analysis is an overview of the business in the past year. It usually includes new hires and new product introductions. At the same time, it will introduce business acquisitions and other important issues.

·Financial Statements

The financial statements are very important for an annual report. People can know the company's performance in the past from the statements. It usually three aspects. The first one is the profit and loss statement. The second one is the balance sheet. And the third one is the cash flow statement.

( ) 26. An annual report of a company provides some information about its business performance for certain people.

( ) 27. People can know everything of the company from the annual report.

( ) 28. An annual report usually includes chairman's letter, financial statements and operation analysis.

( ) 29. A chairman's letter should include the strategic direction moving forward.

( ) 30. This passage is mainly about the main parts of an annual report.

参考答案:26-30:T F T F T

第8题:

(c) State one advantage to a business of keeping its working capital cycle as short as possible.

(2 Marks)

第9题:

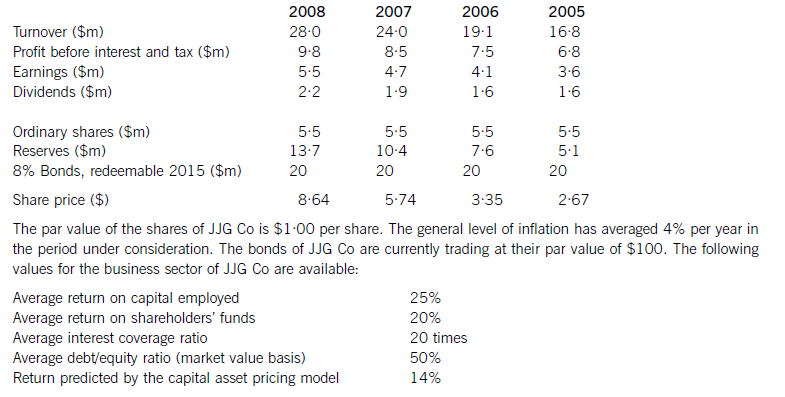

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

第10题:

We were astonished _______ the temple still in its original condition.

A.finding

B.to find

C.find

D.to be found